Traders and the use of support and resistance

Traders use support and resistance in many different ways, mainly due to either of the things below

- The directional bias of the market

- Timing a trade entry in the market

- Finding points to exit the market at either a profit or loss

Traders are trying to catch trends, they are trying to catch market reversals, tracing back to where all their analysis starts, it always leads you back to support and resistance, but what are support and resistance levels?

Support

A support area refers to a specific price level or zone where a bullish tone is expected to enter the market and prevent the price of a currency pair from falling further. According to most retail knowledge, this level is typically identified by a series of previous lows that have not been breached, indicating a strong demand for the currency pair at that particular price point. In this tutorial on support and resistance you will discover that support is not simply previously unbreached lows that will not be breached again, it is much more than that. You will see examples of where the price is really supported.

Resistance

A price level or zone where a bearish tone is expected to enter the market and prevent the price of a currency pair from rising further is referred to as a resistance area. Most retail knowledge indicates that this level is typically identified by a series of previous highs that have not been broken, indicating a strong lack of interest in the currency pair at that price point. In this support and resistance tutorial You will discover that support is much more than previously unbroken highs that will not be breached again. You will see examples of where price is truly supported. Learn the real use of old highs and old lows in our article: "Understanding liquidity in Forex trading: Full guide"

Real support and resistance: PD arrays

When we look at prices in the marketplace, we want to be looking at the price in terms of it being cheap or expensive, we just have to know when it is cheap or expensive. To make this easier for traders, ICT divided this PD array matrix into premium and discount. So it's either price is in a discount or it is in premium. to simplify this I will use diagrams. The first example will be about the idea of catching a trade in an ongoing trend, Usually, people follow the concept of support broken turns resistance in downtrends and resistance broken turns support in bullish trends, but is that what is really happening? But first, let us Identify our PD arrays, they are not a lot.

Bullish PD arrays

These ones are found in discount price areas, they include:

-Bullish Fair Value Gap

-Bullish Order Block

-Old lows

Bearish PD arrays

These ones are found in premium price areas, they include:

-Bearish Fair Value Gap-Bullish Order Block-Old lows

This article will only focus on Fair Value Gaps because they are the most efficient, most frequent and they are the easiest to find on a price chart. We are not going to waste a lot of time defining these levels in theory, we want to be practical, so we will be working on how to identify them when we go into a price chart. Let's start with identifying the bullish and bearish Fair Value Gap.

Bullish Fair Value Gap

-A fair value gap in a simple explanation is a state in price delivery where only one side of market liquidity has been offered, now a bullish fair value gap is a state in price delivery where only buy-side liquidity or up move in price has been offered. Without worrying about the definition below shows what a bullish FVG looks like on a price chart Below is what a Fair Value Gap looks like

So that is Our first PD array, a Fair value Gap, you only need three candles to see it form, on that gap, we can see that only the body of the green candle has passed through, which means only Buy side liquidity has been offered, so the price becomes inefficient, but what's important is that price is likely to come back to fill this gap, to compensate for sell-side liquidity that was not offered, so, in this case, this Gap acts as support, it supports price, this is the most frequently respected PD array, and it is the easiest to spot on a chart. Now let us see on a price chart what it would look like supporting price.

There are a lot of examples we can provide on this one, go into the charts and see for yourself if these fair value gaps are supporting price. If you notice the second example, the price tested this level twice, of course, basic support and resistance worked on this one, but what was the origin of support, it was the FVG, you are going to be fascinated by how many times this PD array works. In the article: CADJPY swing trade break down, forex trading strategy, we apply this exact same concept, to see how we did it, check it out.

Now The bearish FVG is just the opposite of this, but let's see some examples to solidify this concept.

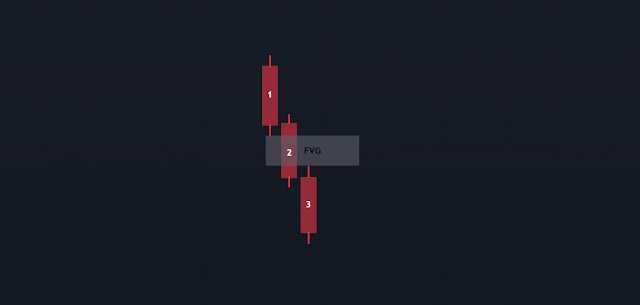

Bearish Fair Value Gap

Opposite to a bullish FVG, a bearish fair value gap is a state in price delivery where only sell-side liquidity or a down move in price has been offered.

Below is how you identify it in a price chart.

As you can see, just like the bullish example, it is a three-candle formation where you need the low of candle 1, the body of candle 2, and the high of candle 3, the difference between the low and the high is your Fair Value Gap. As we discussed, this gap is an inefficiency, because only the sell side or down move has been delivered, so to compensate for that inefficiency in price, price will come back to fill the gap. So in that case this gap acts as resistance to price, preventing it from going any higher. Let us look at the chart below to see what it actually looks like acting as resistance in price.

As you can see there are countless examples of this PD array acting as resistance, This is real support and resistance, nothing works better than this. We talk more about premiums and discounts on this site, but in this article, we wanted to only focus on PD arrays which are our real support and resistance areas.

Support and Resistance Key Takeaways

-Support and resistance does not only end on being levels that were respected a couple of time, it is way more than that-PD arrays act as real support and resistance-Bullish Fair Value Gaps act as real support levels-Bearish Fair Value Gaps act as real resistance levels

Suggested Articles:

Tags:

Technical Analysis

!["Forex Trading Made Easy: Learn Strategies and Tips for Profitable Trading | [TK trades]" "Forex Trading Made Easy: Learn Strategies and Tips for Profitable Trading | [TK trades]"](https://blogger.googleusercontent.com/img/a/AVvXsEjvOOOdtpMjHnyNQxhldP5KQM9YSjXciFKEGjU__v8EGITMclS-rSM8tYHwwiniO4iISRWUC6YmkfHEBv5kMZ2yHPASajQG49ZI0PlcMeWwK0TVMpruojCGvwW0wRS5P9K6-i8tH6y5YyWlzmU0KrlXDUK_e1HurmHtA2UEh_ygIwyx6m1aFB35cBx5Fw=s598)